Endorsing a Cheque: Tips from Financial Experts

How to Endorse a Cheque: Tips from Financial Experts

Endorsing a cheque might seem straightforward, but understanding the proper techniques can protect your finances and ensure smooth transactions. Whether you’re depositing a personal cheque, transferring funds to someone else, or handling business payments, knowing the correct endorsement methods is essential for avoiding fraud and maintaining clear financial records.

Financial experts emphasize that cheque endorsement is more than just signing the back—it’s a legal declaration of intent that carries real consequences. A poorly executed endorsement can delay processing, create security vulnerabilities, or even invalidate the cheque entirely. This comprehensive guide walks you through everything you need to know about endorsing cheques properly.

Understanding Cheque Endorsement Basics

A cheque endorsement is the signature and sometimes additional information written on the back of a cheque that authorizes the transfer of funds. According to financial authorities and banking regulations, the person whose name appears on the front of the cheque (the payee) must endorse it before depositing or transferring it to another party.

The endorsement serves several critical purposes. First, it proves that you’ve authorized the cheque’s use. Second, it creates a legal chain of custody showing who has handled the cheque. Third, it protects banks by ensuring that only authorized parties can deposit the funds. When you endorse a cheque, you’re essentially saying, “I approve this transaction and take responsibility for its accuracy.”

Financial institutions treat cheque endorsements seriously because they’re legally binding. If something goes wrong with an endorsed cheque—such as fraud or forged signatures—the endorser can be held liable. This is why understanding proper endorsement technique matters so much for your financial protection.

The back of a cheque typically has a designated endorsement area marked with lines or a box. Most cheques include instructions stating “Endorse here” or showing where your signature should go. The placement of your endorsement matters because banks use optical scanning technology to read cheques, and signatures in the wrong location can cause processing delays.

Types of Cheque Endorsements

Financial experts recognize several distinct types of cheque endorsements, each serving different purposes and carrying different implications for security and liability.

Blank Endorsement is the simplest form—you simply sign your name on the back of the cheque without any additional information. While convenient, this method poses significant security risks. Anyone who obtains the cheque can deposit or cash it, since there’s no restriction on who can use it. Experts strongly recommend avoiding blank endorsements for valuable cheques, as they essentially turn the cheque into cash.

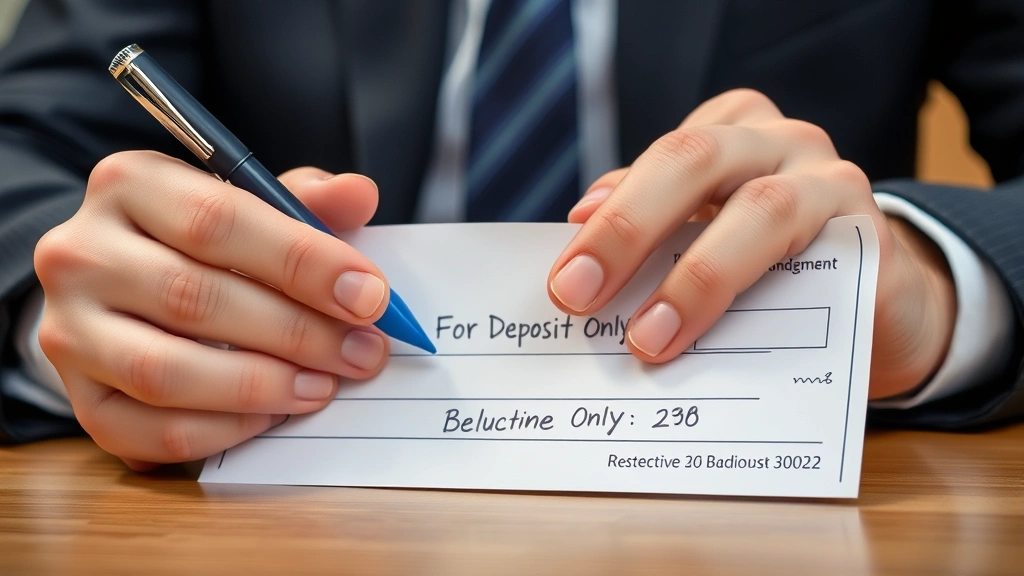

Restrictive Endorsement is the most secure option and the one financial professionals recommend for most situations. You write “For Deposit Only” followed by your account number and signature. This endorsement restricts the cheque’s use exclusively to deposit into your specified account. Even if someone steals the cheque, they cannot cash it or deposit it elsewhere. Banks prefer restrictive endorsements because they reduce fraud risk significantly.

Special Endorsement (also called third-party endorsement) allows you to transfer the cheque to another person. You write “Pay to the order of [person’s name]” followed by your signature. This creates a new payee who can then deposit or further endorse the cheque. However, many banks now restrict or prohibit special endorsements due to fraud concerns, so always verify with your financial institution before using this method.

Conditional Endorsement includes specific conditions or limitations on cheque use. For example, you might write “Pay upon receipt of invoice” or similar conditions. While legally valid, conditional endorsements can complicate processing and may be rejected by banks unfamiliar with the specific terms.

Step-by-Step Endorsement Process

Proper cheque endorsement follows a systematic process that ensures accuracy and security. Here’s how financial experts recommend doing it:

Step 1: Locate the Endorsement Area

Turn the cheque over to the back side. You’ll see a designated space typically in the upper portion of the back, often marked with lines or a box. This is your endorsement area. Some cheques include printed instructions showing exactly where to sign. Never sign in random locations on the back of the cheque, as this can cause processing issues.

Step 2: Verify Cheque Details

Before endorsing, verify that the cheque amount, date, and payee name are correct. Ensure your name matches exactly how it appears on the front of the cheque. If there’s a discrepancy—such as a nickname versus your legal name—contact the cheque writer to issue a corrected cheque. Endorsing an incorrectly made-out cheque can create complications during processing.

Step 3: Choose Your Endorsement Type

Decide which endorsement method suits your situation. For most personal deposits, restrictive endorsement provides the best security. If you’re depositing through a bank or credit union, ask your financial institution which endorsement type they prefer. Some banks have specific requirements or preferences that streamline processing.

Step 4: Write Clearly and Legibly

Using blue or black ink (never pencil), write your chosen endorsement. For restrictive endorsement, write “For Deposit Only” clearly in the endorsement space. Add your account number beneath this phrase. Keep your writing legible—illegible endorsements can cause processing delays or rejection.

Step 5: Sign Consistently

Sign your name exactly as it appears on the front of the cheque and as it’s registered with your bank. Your signature should match your banking records as closely as possible. Banks use signature verification to prevent fraud, so consistency matters. If your signature differs significantly from your banking records, the cheque may be rejected or flagged for verification.

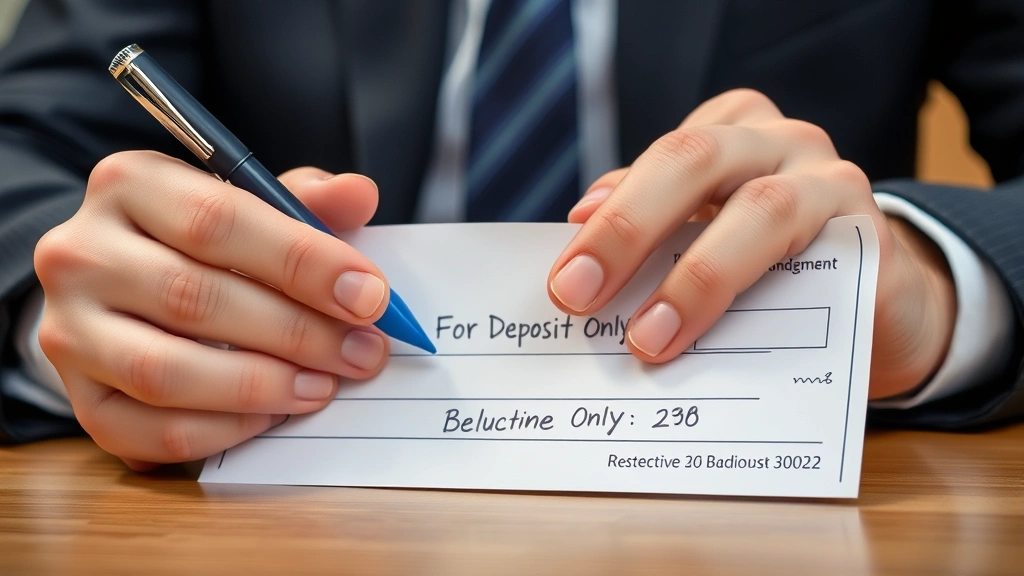

Step 6: Keep the Endorsement Compact

Limit your endorsement to the designated area. Banks use automated scanning equipment that reads specific zones on the cheque back. Endorsements that extend beyond the proper area can interfere with scanning and cause processing problems. Keep everything within the marked lines or box.

Step 7: Deposit Promptly

Once endorsed, deposit the cheque as soon as possible. Don’t carry endorsed cheques around for extended periods, as this increases theft risk. If you’re making a mobile deposit, photograph both sides of the cheque immediately after endorsement, then deposit securely.

Security Best Practices

Financial security experts emphasize several critical practices for protecting yourself when endorsing cheques. These measures significantly reduce fraud risk and protect your financial interests.

Use Restrictive Endorsement Always

Unless you have a specific reason to use another endorsement type, always use restrictive endorsement with “For Deposit Only” and your account number. This single practice eliminates the vast majority of cheque-related fraud risks. Even if someone steals the endorsed cheque, they cannot deposit it into their own account.

Endorse Only When Depositing

Don’t endorse cheques in advance or before you’re ready to deposit them. The longer a cheque remains endorsed, the greater the theft risk. Some experts recommend endorsing only moments before depositing to minimize the window of vulnerability.

Never Endorse Blank Cheques

If you receive a cheque with the amount left blank or the payee line blank, do not endorse it. Return it to the writer immediately and request a properly completed cheque. Endorsing incomplete cheques creates legal and financial liability for you.

Verify Cheque Authenticity

Before endorsing, examine the cheque for signs of tampering, forgery, or alteration. Look for erasures, white-out, or uneven printing. If anything seems suspicious, contact the cheque writer to verify its authenticity before endorsing. Depositing fraudulent cheques can create serious banking complications for you.

Protect Your Endorsed Cheques

Treat endorsed cheques like cash. Store them securely until deposit. Never leave endorsed cheques unattended or visible. If you’re making a mobile deposit, delete the photographs after successful deposit to prevent unauthorized access if your phone is compromised.

Monitor Your Account

After depositing an endorsed cheque, monitor your account to confirm the deposit posts correctly. Financial consumer protection agencies recommend checking account activity regularly to catch any fraudulent deposits or errors quickly.

Common Endorsement Mistakes

Understanding common errors helps you avoid problems. Financial professionals see these mistakes repeatedly, and they cause unnecessary complications.

Signing in the Wrong Location

Many people sign anywhere on the cheque back without using the designated endorsement area. Banks use automated scanning equipment calibrated for specific zones. Signatures outside these zones can cause the cheque to be rejected or returned for reprocessing, delaying your deposit by days or weeks.

Using Pencil Instead of Ink

Pencil endorsements are easily erased and altered, creating fraud risk. Always use permanent blue or black ink. Banks may reject pencil-endorsed cheques due to security concerns. Some financial institutions have explicit policies against accepting pencil endorsements.

Endorsing Illegibly

Illegible signatures cause verification problems. Banks compare your endorsement signature to your banking records. If they can’t read your signature clearly, they may reject the cheque or contact you for verification. Take time to sign legibly and consistently.

Changing Your Signature

If your signature on the cheque differs dramatically from your banking records, the cheque may be rejected. Banks use signature verification as a fraud prevention tool. If your signature has changed significantly, contact your bank to update your signature records before depositing cheques.

Endorsing Without Proper Authorization

Only the payee named on the cheque should endorse it. If you’re not the named payee, you cannot legally endorse the cheque yourself. Attempting to do so constitutes fraud. If you receive a cheque made out to someone else, that person must endorse it or you must obtain proper authorization.

Adding Unnecessary Information

While some information (like account numbers for restrictive endorsement) is helpful, adding excessive details complicates processing. Stick to essential information: “For Deposit Only,” your account number, and your signature. Avoid adding dates, conditions, or other unnecessary notes unless your bank specifically requests them.

Digital and Mobile Cheque Deposits

Modern banking has transformed cheque endorsement practices. Many banks now accept mobile deposits through smartphone apps, which changes how you should approach endorsement.

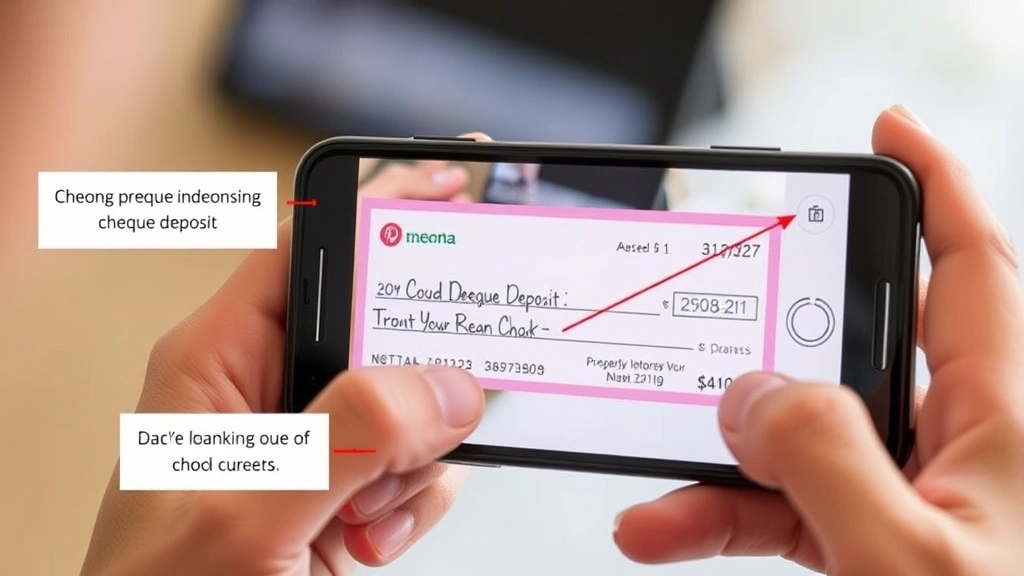

Mobile Deposit Endorsement

When making a mobile deposit, endorse the cheque exactly as you would for in-person deposit—using restrictive endorsement with “For Deposit Only,” your account number, and your signature. Photograph both the front and back of the endorsed cheque clearly and securely. Most banks require clear, legible images for processing.

Digital Security Considerations

After successfully uploading cheque images to your bank’s app, delete the photographs from your phone. This prevents unauthorized access if your device is lost or stolen. Some experts recommend using your phone’s secure deletion feature rather than standard deletion to ensure photos cannot be recovered.

Verification Processes

Banks processing mobile deposits use sophisticated verification technology to confirm endorsements. Some institutions require additional verification steps, such as confirming the deposit amount or providing identification. Follow your bank’s procedures exactly to ensure successful processing.

Processing Timelines

Mobile deposits typically process within 1-2 business days, similar to in-person deposits. However, some banks hold mobile deposits longer for verification purposes. Check your bank’s specific policies regarding mobile deposit holds and processing times.

Limitations and Restrictions

Not all cheques qualify for mobile deposit. Cheques over certain amounts, post-dated cheques, or cheques with special endorsements may require in-person deposit. Contact your bank to confirm that your specific cheque qualifies for mobile deposit before endorsing and uploading.

FAQ

What if I make a mistake when endorsing a cheque?

If you make a minor error (such as a small signature variation), you can often cross out the error, initial the correction, and resubmit. For significant errors, request a new cheque from the writer. Never attempt to alter an endorsement substantially, as this can raise fraud concerns and cause the cheque to be rejected.

Can I endorse a cheque made out to my business?

Yes, but only if you’re authorized to do so. If the cheque is made out to your business name, you typically sign your name followed by your title (such as “Owner” or “Manager”). Verify with your bank regarding their specific requirements for business cheque endorsements.

What happens if someone else endorses my cheque?

If someone endorses a cheque made out to you without authorization, that constitutes fraud. Contact your bank immediately and file a fraud report. Do not deposit the cheque. Your bank can help you pursue recovery and prevent further fraudulent activity.

Is there a time limit for endorsing a cheque?

While no legal time limit exists for endorsement, cheques can become “stale” after six months. Banks may refuse to process cheques older than six months, even if properly endorsed. Deposit cheques promptly after receiving them to avoid stale-cheque issues.

Can I endorse a cheque twice?

Yes, but this is uncommon and often discouraged. If you endorse a cheque and then transfer it to someone else, they can add their endorsement. However, many banks now restrict multiple endorsements due to fraud concerns. Check with your financial institution before attempting multiple endorsements.

What’s the difference between endorsement and signature?

An endorsement is a specific signature on the cheque back that authorizes its use. Your regular signature appears on the cheque front when you write it. These serve different purposes: the front signature indicates the cheque writer authorized the payment, while the endorsement indicates the payee authorized receiving or transferring the funds.

Do I need to endorse cheques deposited through ATM?

Yes, ATM deposits require proper endorsement just like in-person deposits. Endorse the cheque with “For Deposit Only” and your account number before inserting it into the ATM. The ATM will capture images of both sides, and your endorsement must be clearly visible.

Can I endorse a cheque with a digital signature?

Digital signatures on mobile deposits typically appear as photographed handwritten signatures, which is acceptable. However, purely electronic signatures (without a handwritten component) may not be accepted by all banks. Check your bank’s specific policies regarding digital endorsement methods.