How to Read a Check? Easy Guide for Beginners

How to Read a Check: Easy Guide for Beginners

Understanding how to read a check is an essential financial skill that many people overlook in today’s digital banking world. Whether you’re depositing a paycheck, receiving payment for services, or verifying a business transaction, knowing how to interpret every element of a check ensures you catch errors and protect yourself from fraud. A check is a written order directing a bank to pay a specific amount of money from one account to another, and it contains multiple security features and important details that work together to process the payment safely.

This comprehensive guide will walk you through every component of a check, explain what each number and field means, and provide practical tips for reading checks accurately. By the end, you’ll understand not just how to read a check, but also how to spot potential problems and verify that all the information is correct before depositing or cashing it.

Understanding Check Anatomy

A standard check contains multiple fields and numbers that work together to ensure the payment reaches the correct account in the correct amount. The front of the check displays most of the critical information you need to read, while the back includes space for endorsement and additional bank processing information. Learning to identify each component is the foundation for understanding how to read a check effectively.

The layout of a check follows a standardized format established by banking regulations, which means once you understand one check, you can read virtually any check from any financial institution. The information flows from top to bottom and includes the bank’s name and logo, the account holder’s information, and the specific payment details. Each element serves a distinct purpose in the check clearing process, and all of them must be accurate for the check to be processed correctly.

Banks use sophisticated systems to read checks automatically, scanning the numbers and routing information at the bottom of the check. However, human errors still occur, which is why you should always manually verify the key details before accepting or depositing a check. This is especially important when dealing with large amounts or unfamiliar check writers.

The Routing Number Explained

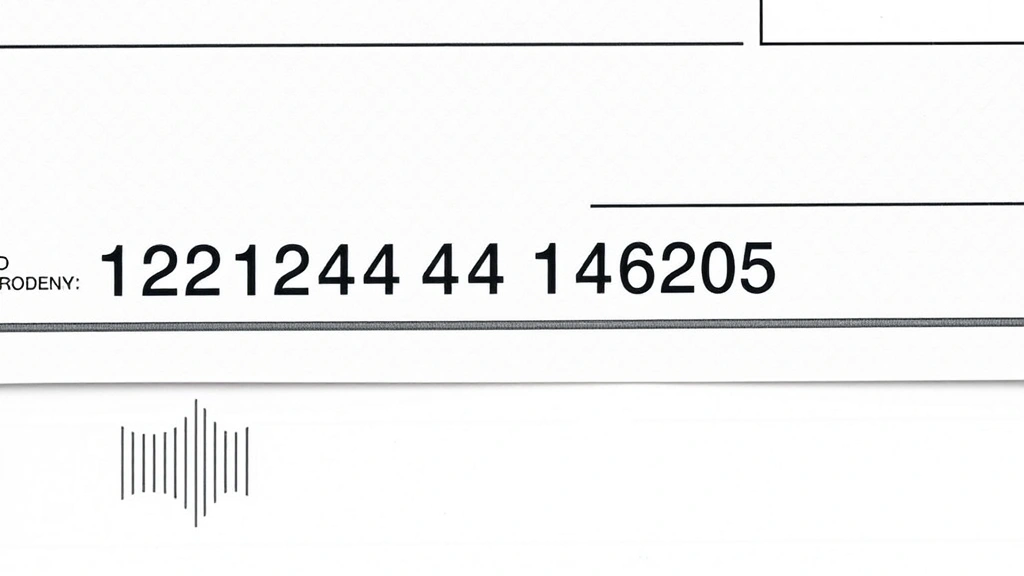

The routing number is a nine-digit code that identifies the specific bank branch where the check account is held. This number appears in the bottom-left corner of the check and is one of the most critical pieces of information for processing the payment. Banks use the routing number to determine where to send the check for payment, ensuring the funds are drawn from the correct financial institution.

The routing number format follows a specific structure: the first four digits identify the Federal Reserve routing region, the next four digits identify the specific bank, and the final digit is a check digit used to verify that the routing number is valid. You can verify a routing number by visiting the American Bankers Association website, which maintains an official database of all valid routing numbers. If you’re unsure whether a routing number is legitimate, checking this database is an excellent safeguard against fraud.

Different branches of the same bank may have different routing numbers, so it’s important to use the correct routing number for the specific branch where the account is held. If you’re setting up automatic bill payments or direct deposits, always verify the routing number matches the correct bank branch. Mismatched routing numbers can cause checks to be sent to the wrong bank, resulting in delays and processing errors.

Account Number and Check Number

Immediately to the right of the routing number, you’ll find the account number, which is typically 10 to 12 digits long. This number identifies the specific checking account at the bank, distinguishing it from all other accounts at that same financial institution. The account number is essential for ensuring that money is deducted from the correct account and deposited to the correct destination.

The check number appears in two locations on the check: in the top-right corner and again in the bottom-right section near the account number. This number helps you track individual checks in your personal records and makes it easier to reference a specific check during disputes or inquiries. Most people number their checks sequentially, starting with 1001 or 1000, though the exact starting number varies depending on the check stock you purchase.

When you deposit a check, the bank scans both the routing number and account number to determine where to debit the funds. These two numbers work together to create a unique identifier that routes the payment to the exact account the check writer intends. If either number is incorrect or illegible, the check may be returned as unprocessable, so always verify these numbers are clear and accurate before accepting a check.

Payee and Amount Fields

The payee line, which begins with “Pay to the Order of,” specifies who should receive the payment. This is a critical security feature because the check can only be deposited or cashed by the named payee (or an authorized representative). Always verify that your name appears exactly as written on the payee line before accepting a check, as even minor spelling variations or missing middle initials can cause banking problems.

The amount field appears twice on every check: once in numbers on the right side and once written out in words on the left side. This redundancy serves as a fraud prevention measure; if the two amounts don’t match, the check is considered invalid and banks will typically return it. When you’re reading a check, always compare these two amounts carefully to ensure they agree. The numerical amount should match the written amount exactly, including cents.

The written amount line includes boxes or a line where the dollar amount is spelled out in words, followed by the word “dollars.” Some checks include a cents box where you write the cents amount separately, while others include it in the written line. For example, a check for $1,250.50 would be written as “One Thousand Two Hundred Fifty and 50/100 dollars.” If these amounts don’t match, the check is invalid and should not be accepted.

When writing checks yourself, always ensure the written amount and numerical amount match exactly. If you make an error, void the check and start over rather than attempting to correct it with pen. Banks and recipients will reject checks with alterations or corrections, as these are considered potential fraud indicators.

Date and Signature Requirements

The date field on a check indicates when the check was written and serves as the basis for determining whether a check is “stale.” A stale check is one that has not been deposited or cashed within six months of the date written. Banks are not legally required to honor stale checks, though many do as a courtesy. If you receive a check dated more than six months ago, contact the check writer to request a new check with a current date.

The signature line at the bottom right of the check is where the account holder authorizes the payment. A check is not valid without a signature, and the signature should match the authorized signers on the account. Some accounts require two signatures for checks over a certain amount, in which case both authorized signers must sign the check. If a check appears to have an illegible or suspicious signature, you should contact the check writer to verify its authenticity before depositing it.

Post-dated checks, which are dated in the future, are sometimes used to delay payment. However, banks are not required to honor post-dating and may process the check immediately. If you’ve received a post-dated check and the payment shouldn’t be processed yet, contact the check writer to request a new check with the correct date or arrange alternative payment methods.

Security Features to Verify

Modern checks include numerous security features designed to prevent counterfeiting and fraud. These features include watermarks, security fibers, color-shifting ink, and microprinting that become visible under magnification. When reading a check, examine these security features carefully, especially if you’re accepting a large check or a check from an unfamiliar source. Legitimate checks from established banks will have high-quality security features that are difficult to replicate.

One common security feature is a watermark visible when you hold the check up to light, typically showing the bank’s logo or name. Another feature is security fibers embedded throughout the check stock, which appear as colored threads when you look closely. Some checks use color-shifting ink in specific areas that changes color when tilted, making counterfeiting extremely difficult. Check printing companies like Deluxe and MPC Checks provide detailed information about the security features included in their check stocks.

The MICR line (Magnetic Ink Character Recognition) at the bottom of the check uses special magnetic ink that banking machines can read automatically. This line contains the routing number, account number, and check number in a specific format. If the MICR line appears smudged, faded, or altered in any way, the check may not process correctly through automated systems, and you should contact the check writer for a replacement.

Common Check Reading Mistakes

One of the most common mistakes people make when reading checks is failing to verify that the written amount matches the numerical amount. This discrepancy is a major red flag and indicates either an error or potential fraud. Always take a moment to compare these two amounts before accepting any check, and if they don’t match, request a corrected check from the writer.

Another frequent error is misreading the routing number or account number due to poor printing quality or illegible handwriting. Always verify these numbers carefully, and if you’re unsure about any digit, contact the bank or check writer for clarification. Depositing a check with incorrect routing or account information will result in the check being returned, delaying payment and potentially triggering overdraft fees.

People often overlook the importance of checking the date on a check, especially when receiving multiple checks. A stale check won’t be processed, so verify the date is current before depositing. Additionally, always confirm that your name on the payee line matches your legal name or authorized name on the account where you plan to deposit the check. If there’s a discrepancy, you may need to endorse the check or request a corrected check.

Many people fail to examine the signature for authenticity, particularly when receiving checks from established businesses or trusted sources. However, fraud can happen from anyone, so always verify the signature appears genuine and matches previous signatures from the same check writer if possible. If something looks suspicious, don’t hesitate to contact the issuer for verification.

For more information on managing your finances and understanding banking processes, you can explore the FixWiseHub Blog for comprehensive how-to guides covering various practical topics that help you navigate everyday challenges.

FAQ

What should I do if a check is missing information?

If a check is missing critical information such as the payee name, amount, date, or signature, do not accept it. Request a new check from the issuer with all required information completed. Incomplete checks cannot be processed and are not negotiable instruments under banking law.

Can I deposit a check made out to someone else?

Generally, no. A check made payable to another person must be endorsed by that person before you can deposit it. This requires their signature on the back of the check, and they are responsible for ensuring the funds reach the correct destination. Some banks allow third-party deposits only in specific circumstances, so check with your bank’s policy.

What does “two-party check” mean?

A two-party check is made out to multiple payees, typically written as “Pay to the Order of John Smith and Jane Doe.” Both parties must endorse the check before it can be deposited, and many banks require both to be present when depositing. These checks are less common and can create complications, so it’s best to request a separate check for each payee if possible.

How do I verify a routing number is correct?

You can verify a routing number using the Federal Reserve’s routing number database or the American Bankers Association website. Simply enter the nine-digit routing number to confirm it corresponds to the correct bank and branch. This is especially important for large payments or when setting up automatic transfers.

What should I do if I receive a check with a post-dated date?

If you receive a post-dated check, contact the check writer to request a check with the current date. While you can technically deposit a post-dated check immediately (since banks are not required to honor post-dating), doing so may violate your agreement with the check writer. It’s better to clarify the intended deposit date and request an appropriately dated check to avoid complications.

Can altered or corrected checks be deposited?

No, banks will not process checks that have been altered or contain visible corrections such as crossed-out information or white-out. Even small corrections make checks invalid and create fraud concerns. If a check contains errors, request a new check from the issuer rather than attempting to correct it.

What is the difference between a certified check and a regular check?

A certified check is guaranteed by the bank because the bank has verified that sufficient funds exist in the account and has placed a hold on those funds. Regular checks depend on the account holder having sufficient funds at the time of deposit. Certified checks are considered more secure for large transactions because the bank guarantees payment, whereas regular checks may bounce if insufficient funds are available.