Endorsing Paychecks: Legal Steps to Follow

Endorsing a paycheck to someone else is a financial transaction that requires careful attention to legal requirements and banking regulations. Whether you’re helping a family member, a business partner, or handling an emergency situation, understanding the proper procedures ensures the check clears smoothly and protects both parties involved. This comprehensive guide walks you through everything you need to know about third-party check endorsements, including when they’re permitted, how to execute them correctly, and what alternatives might be safer for your situation.

Many people encounter situations where they need to transfer a paycheck to another person. Perhaps you’re managing finances for an elderly relative, splitting income with a business partner, or temporarily unable to deposit a check yourself. Whatever the reason, the process involves specific legal steps that vary by financial institution and state regulations. Understanding these requirements prevents rejected checks, potential fraud complications, and banking issues that could affect your financial standing.

Understanding Third-Party Check Endorsements

A third-party check endorsement occurs when the paycheck’s original recipient signs the back of the check and adds instructions allowing someone else to deposit or cash it. This differs from a standard endorsement, where you simply sign the check to deposit it into your own account. The third party becomes the new recipient, authorized to complete the transaction on your behalf. This practice has legitimate uses but carries risks that both parties should understand before proceeding.

The original paycheck recipient is called the first party, the person receiving the endorsed check is the second party (or third party from the bank’s perspective), and the financial institution is the third party (or fourth party in this context). Clear communication between all parties about the endorsement process prevents confusion and potential disputes later. The second party should understand that they’re receiving funds on behalf of the original recipient and may need to provide identification when depositing the check.

Third-party endorsements are most common in small business transactions, family financial arrangements, and situations where someone temporarily cannot access their bank account. Real estate transactions sometimes involve third-party checks when closing funds pass through multiple parties. However, not all situations warrant this approach, and understanding when alternatives are better protects everyone involved.

Legal Requirements and Regulations

Federal banking regulations established by the Federal Deposit Insurance Corporation (FDIC) and individual state laws govern check endorsements. The Uniform Commercial Code (UCC), adopted by all states with minor variations, provides the legal framework for negotiable instruments like checks. Under UCC Section 3-201, a check can be negotiated by endorsement and delivery, meaning the original payee can transfer their rights to another party through proper endorsement procedures.

However, the UCC also permits banks to refuse third-party checks at their discretion. This means your financial institution has the legal right to decline processing a third-party check regardless of whether the endorsement is technically valid. Many banks implemented stricter policies after increased fraud incidents, making it increasingly difficult to endorse checks to others. Understanding your specific bank’s policies before attempting to endorse a paycheck prevents frustration and delays in accessing funds.

State laws vary regarding third-party check restrictions. Some states prohibit certain businesses, particularly check-cashing services, from accepting third-party checks. Other states allow them with specific requirements. For example, some jurisdictions require additional identification verification or limit the number of endorsements a single check can receive. Consulting your state’s banking regulations or contacting your bank directly clarifies what’s legally permissible in your location.

The endorser assumes legal responsibility for the check’s validity. If the check bounces or the funds are unavailable, both the original recipient and the person who endorsed it to a third party could face liability. This is why understanding the legal implications protects you from potential financial and legal consequences. Never endorse a check from someone else to a third party without explicit permission and clear understanding of the risks involved.

Step-by-Step Endorsement Process

Properly endorsing a paycheck for someone else requires following specific procedures to maximize the likelihood of successful processing. First, verify that your bank permits third-party check endorsements. Contact your bank’s customer service department or visit your local branch to confirm their current policy. Many banks now refuse third-party checks entirely, so this crucial first step prevents wasted effort and potential embarrassment at the deposit window.

Once you’ve confirmed your bank accepts third-party checks, gather the necessary information. You’ll need the name of the person receiving the check, their signature, and typically their identification. Some banks require the second party to be present when the check is deposited, while others allow the original recipient to complete the endorsement independently. Clarifying these requirements with your bank prevents complications during deposit.

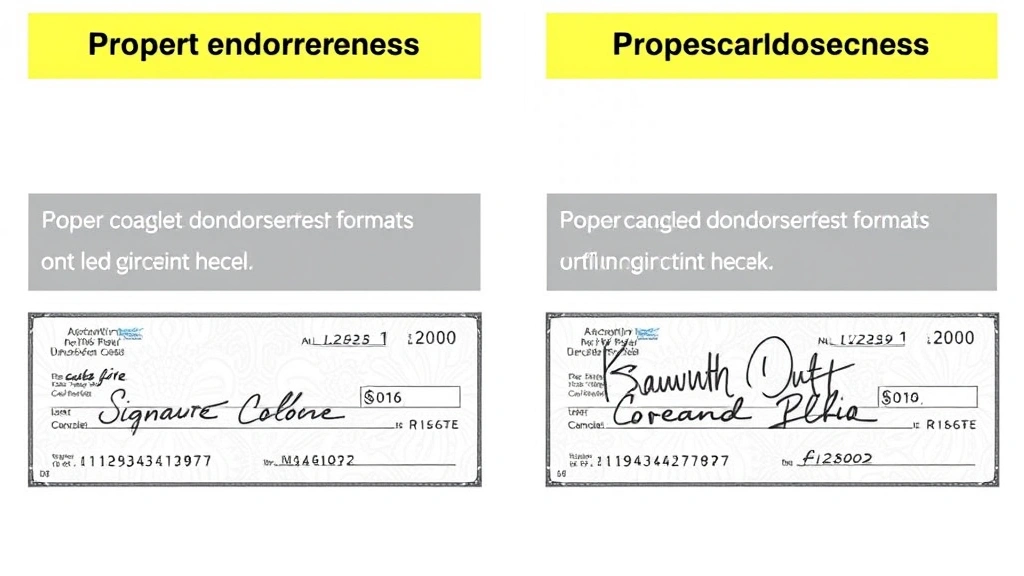

On the back of the check, locate the endorsement area—typically a blank space at the top of the reverse side. Write “Pay to the order of” followed by the second party’s name. This transfers your rights to that specific person. Below this line, sign your name exactly as it appears on the front of the check. Your signature authorizes the transfer and indicates your agreement to the endorsement. The second party then signs below your endorsement, indicating their acceptance and agreement to deposit or cash the check.

Some endorsements include a memo line where you can note the reason for the third-party transfer, such as “payment for services” or “loan repayment.” While not always required, including this information creates a clear record of the transaction’s purpose and can help if questions arise later. The second party should bring valid identification when depositing the check, as banks typically require ID verification for third-party checks.

Timing matters when endorsing checks. Complete the endorsement as close to the deposit date as possible. Checks endorsed too far in advance may raise fraud concerns, and banks might refuse to process them. If the endorsement occurs days before deposit, the bank may question whether the transfer was authorized and legitimate. Coordinating with the second party to ensure prompt deposit after endorsement streamlines the process and reduces potential complications.

Bank Policies and Restrictions

Modern banking institutions have significantly tightened policies regarding third-party checks due to fraud prevention concerns. Major banks including Bank of America, Chase, and Wells Fargo now refuse most third-party checks outright. Credit unions and smaller regional banks sometimes maintain more flexible policies, but even these institutions have implemented stricter verification procedures. Before attempting to endorse a paycheck, contact your specific financial institution to understand their current rules.

Banks that do accept third-party checks typically impose restrictions on who can receive them. Many require the second party to have an account at the same bank, eliminating the possibility of endorsing checks to individuals with accounts elsewhere. Some institutions limit third-party checks to specific types of transactions or require both parties to be present during deposit. Payroll checks and government benefit checks sometimes face additional restrictions or outright refusal, regardless of endorsement legitimacy.

The amount of the check influences acceptance decisions at some banks. Larger checks may trigger additional scrutiny or automatic refusal due to fraud concerns. Some institutions set maximum amounts for third-party checks, refusing to process anything exceeding their threshold. Understanding these limits prevents disappointment when attempting to deposit a larger endorsed check. If your bank refuses a particular check, asking about their specific reasons helps you determine whether alternative methods might work.

Documentation requirements vary significantly between institutions. Some banks require written authorization from both parties, notarized statements, or additional forms beyond the standard endorsement. Others require the second party to provide multiple forms of identification or proof of relationship to the original recipient. These requirements exist to verify the transaction’s legitimacy and protect the bank from fraud liability. Asking about documentation needs in advance allows you to gather necessary materials before attempting deposit.

Safer Alternatives to Consider

Given modern banking restrictions, exploring safer alternatives often provides better results than attempting third-party endorsement. Direct deposit represents the most secure option if available through your employer. By providing your employer with your bank account information, paychecks deposit automatically without requiring physical checks or endorsements. This eliminates the need to transfer funds to anyone else and ensures reliable, timely payment processing.

Mobile check deposit services offered by most banks allow you to photograph the check and submit it through your bank’s mobile app or website. Once deposited into your account, you can transfer funds to the second party using electronic transfer methods. This approach bypasses third-party endorsement complications entirely while maintaining clear records of all transactions. The second party receives funds through secure electronic transfer rather than a physical check, reducing fraud risks for both parties.

Automated Clearing House (ACH) transfers provide another excellent alternative for transferring paycheck funds to someone else. If the second party has a bank account, you can deposit the check into your account and immediately transfer the desired amount via ACH. This method creates a clear paper trail, protects both parties legally, and typically processes within one to three business days. ACH transfers are free at most banks and represent the standard method for transferring funds between accounts.

Payroll direct deposit to a third party’s account is sometimes possible if you provide your employer with authorization. Some employers allow employees to split direct deposits between multiple accounts or to designate a portion of their paycheck for direct deposit to another person’s account. This arrangement requires employer cooperation and specific authorization, but it eliminates check handling entirely. Contact your employer’s payroll department to inquire whether this option is available for your situation.

Money transfer services like Western Union or peer-to-peer payment apps provide alternatives for transferring funds once you’ve deposited the check. While these services charge fees, they offer convenience and security that third-party endorsements no longer provide. The second party receives funds quickly without needing to be present at the bank or dealing with check-related complications. For emergency situations, these services often provide same-day or next-day delivery of funds.

Common Mistakes to Avoid

One frequent error involves endorsing the check incorrectly or incompletely. Ensure your signature matches the name printed on the check exactly. If your name appears as “John Michael Smith” on the paycheck, sign it that way, not as “J.M. Smith” or “John Smith.” Signature mismatches create complications and may cause banks to refuse processing. Similarly, verify that the second party signs in the correct location and with their legal name as it appears on their identification.

Many people endorse checks to multiple parties simultaneously, which creates legal and practical complications. A check should only be endorsed to one specific person at a time. If multiple people need to receive funds from a single check, the proper approach involves depositing the check into an account and then distributing funds through separate transactions. Attempting to endorse a check to multiple parties violates standard banking procedures and virtually guarantees refusal.

Failing to obtain proper authorization from all parties involved creates serious legal problems. Never endorse a check that belongs to someone else without their explicit permission and knowledge. Similarly, never accept an endorsed check from someone without understanding the transaction’s legitimacy and your legal obligations. Unauthorized check endorsements constitute fraud and can result in criminal charges, civil liability, and permanent damage to your financial reputation.

Waiting too long to deposit an endorsed check causes problems when banks identify potential fraud concerns. Checks have a standard validity period of six months, but banks may refuse third-party checks that appear stale or suspicious due to timing. Coordinate with the second party to ensure deposit occurs promptly after endorsement. If circumstances prevent timely deposit, contact your bank to discuss options before attempting to process the check.

Endorsing government checks or benefit checks requires special caution. Social Security, disability benefits, unemployment benefits, and other government payments often cannot be endorsed to third parties due to federal regulations. Attempting to endorse these checks violates the law and can result in criminal charges. Always verify whether a specific type of check can legally be endorsed before attempting the process. If you need help managing government benefit checks, contact the issuing agency about authorized representative options.

Neglecting to keep records of endorsed checks creates problems if disputes arise later. Both parties should maintain documentation of the endorsement, including photographs of the endorsed check, deposit receipts, and any communications about the transaction. These records protect you if questions arise about whether the endorsement was authorized or legitimate. Clear documentation also helps resolve any issues with the check bouncing or funds being unavailable.

FAQ

Can you legally endorse a paycheck to someone else?

Legally, third-party check endorsements are permitted under the Uniform Commercial Code, but individual banks have the right to refuse them. While the legal framework allows endorsements, most modern banks decline to process third-party checks due to fraud concerns. Always verify your bank’s specific policy before attempting to endorse a check to another person. Some banks accept third-party checks only under specific circumstances or with additional documentation requirements.

What happens if a bank refuses an endorsed check?

If your bank refuses an endorsed check, they’ll typically return it to you with a notice explaining their refusal. You can attempt to deposit the check into your own account instead, then transfer funds to the second party through electronic means. Alternatively, contact your bank to discuss whether they’ll accept the check with additional documentation or under different circumstances. Some banks refuse certain types of checks categorically while accepting others on a case-by-case basis.

Is it safe to endorse a check to someone you don’t know well?

Endorsing a check to someone you don’t know well carries significant risks. You become liable if the check bounces, and you have limited recourse if the person fails to deposit the check or mishandles the funds. Additionally, you’re essentially giving that person legal authority over funds that belong to you. Only endorse checks to people you trust completely and with whom you have clear agreements about the transaction’s purpose and terms.

Can you endorse a check twice?

Technically, a check can receive multiple endorsements, but this practice creates substantial complications. Each endorsement adds another party to the transaction, increasing fraud concerns and the likelihood that a bank will refuse processing. Most banks will not accept checks with multiple endorsements. If multiple people need to receive funds from one check, the proper approach involves depositing it into an account and making separate payments to each recipient.

What’s the difference between endorsing and cashing a check?

Endorsing a check involves signing the back to authorize transfer to another person, while cashing involves converting the check to physical currency. When you endorse a check to someone else, they become authorized to either deposit it into their account or cash it. The original recipient doesn’t receive the funds; the second party does. Cashing an endorsed check works similarly to cashing a regular check, except the payee has already transferred their rights to another party.

Do both parties need to be present when depositing an endorsed check?

Requirements vary by bank. Some banks require both the original recipient and the second party to be present when depositing an endorsed check. Others allow the second party to deposit alone if they have a valid endorsement and proper identification. Contact your bank in advance to confirm their specific requirements. If both parties must be present, coordinate timing to ensure you can both visit the bank together.

Can you endorse a check to yourself and someone else?

While technically possible under the Uniform Commercial Code, most banks will refuse checks endorsed to multiple parties. The proper approach if you and another person both need funds from a check involves depositing it into an account and then making separate payments to each recipient. This method creates clearer documentation and avoids the complications that multi-party endorsements create for banking institutions.

What if the check is made out to two people?

Checks made out to two people using “and” typically require both people to endorse before the check can be deposited. Checks using “or” typically require only one person’s endorsement. Verify the exact wording on your check to determine whether one or both recipients must sign. If you need to endorse a joint check to a third party, both original recipients typically must provide their endorsement and authorization for the third-party transfer.