Writing checks may seem like an old-fashioned practice in our digital age, but many people still rely on paper checks for various transactions. Whether you’re paying rent, settling bills, or making important purchases, knowing how to properly handle checks is a crucial financial skill. One essential aspect of check management that often catches people off guard is learning how to void a check correctly.

Voiding a check is a common requirement for many financial situations, from setting up direct deposits to establishing automatic bill payments. Understanding the proper technique for voiding checks can save you from costly mistakes, prevent fraud, and ensure your financial transactions proceed smoothly. This comprehensive guide will walk you through everything you need to know about voiding checks, including when it’s necessary, step-by-step instructions, and important security considerations.

What Is Voiding a Check?

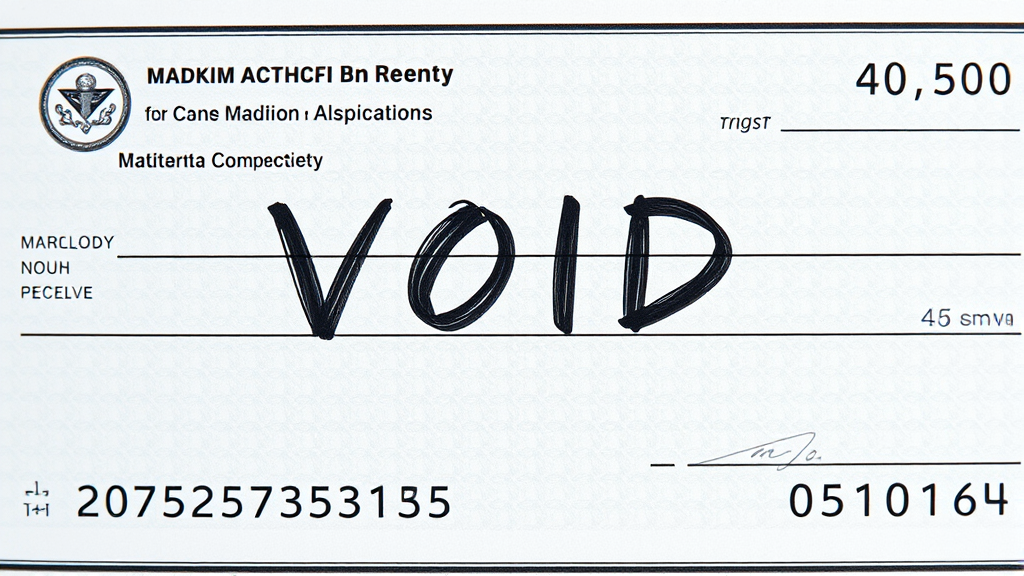

Voiding a check is the process of marking a blank check as unusable while preserving the important banking information printed on it. When you void a check, you’re essentially canceling it before it can be used for any monetary transaction. The voided check serves as a source of your banking details, including your account number, routing number, and bank information, without creating any financial liability.

A properly voided check cannot be filled out, cashed, or deposited by anyone. The word “VOID” written across the check makes it clear that this document should not be processed for payment. However, the banking information remains visible and readable, which is precisely why voided checks are requested by employers, utility companies, and other organizations.

The concept of voiding checks has been around as long as checking accounts themselves. Banks and financial institutions recognize voided checks as legitimate proof of account ownership and banking relationship. This recognition makes voided checks an accepted standard for various administrative and financial procedures.

When Do You Need to Void a Check?

There are numerous situations where you might need to provide a voided check. Understanding these scenarios helps you prepare and ensures you’re ready when the need arises. The most common situations include:

Direct Deposit Setup: Employers frequently request voided checks when setting up direct deposit for payroll. This allows them to verify your banking information and ensure your paychecks are deposited into the correct account. The process is similar to other professional situations where you might need to demonstrate your credentials, such as when learning how to answer tell me about yourself during job interviews.

Automatic Bill Payments: Many service providers, including utilities, insurance companies, and loan servicers, require voided checks to set up automatic payment systems. This ensures they have accurate banking information for recurring transactions.

Investment Account Funding: When opening investment accounts or retirement plans, financial institutions often request voided checks to establish electronic fund transfers between your checking account and investment accounts.

Government Benefits: Social Security, unemployment benefits, tax refunds, and other government payments often require voided checks for direct deposit setup. The Social Security Administration provides detailed information about their direct deposit requirements.

Loan Applications: Some lenders request voided checks as part of the application process to verify banking relationships and establish payment methods for loan servicing.

Step-by-Step Process to Void a Check

Learning how to void a check properly is straightforward, but attention to detail is crucial. Follow these steps to ensure you create a properly voided check:

Step 1: Get a Blank Check

Start with a blank check from your checkbook. Never use a check that has already been filled out, even partially. The check should be completely blank with no writing in any of the fields.

Step 2: Use Dark Ink

Choose a dark pen, preferably black or blue ink. Avoid pencils or light-colored pens that could be erased or altered. The goal is to make permanent, clearly visible marks.

Step 3: Write “VOID” Across the Check

Write the word “VOID” in large, clear letters across the entire face of the check. Make sure the word covers the main body of the check, including the amount fields and signature line. The letters should be large enough to be easily readable but not so large that they obscure the banking information at the bottom.

Step 4: Verify Banking Information Remains Visible

Ensure that your account number, routing number, check number, and bank name remain clearly visible. These details are typically printed at the bottom of the check and are essential for the organizations requesting the voided check.

Step 5: Double-Check Your Work

Review the voided check to confirm that “VOID” is clearly written and that all necessary banking information is still readable. The check should be obviously unusable for payment while maintaining its informational value.

Common Mistakes to Avoid

Even though voiding a check is a simple process, several common mistakes can create problems or security risks. Being aware of these pitfalls helps ensure you handle the process correctly:

Using Light or Erasable Ink: One of the most significant mistakes is using pencil or light-colored ink that could be erased or altered. Always use permanent, dark ink to prevent tampering.

Obscuring Banking Information: Writing “VOID” too large or in the wrong location can cover critical banking details. The routing number, account number, and bank information must remain clearly visible for the voided check to serve its purpose.

Partially Filling Out the Check: Never write any amount, date, or payee information on a check you intend to void. Start with a completely blank check to avoid confusion or potential misuse.

Using the Wrong Check: Ensure you’re using a check from the correct account. If you have multiple checking accounts, verify you’re voiding a check from the account you want to link to the service or employer.

Poor Record Keeping: Failing to record which check number you voided can create confusion in your check register. Always note voided checks in your records, similar to how you might need to carefully track other important communications, such as when you need to recall an email in outlook.

Security Considerations and Best Practices

While voided checks don’t represent monetary value, they contain sensitive banking information that requires careful handling. Implementing proper security measures protects your financial information and prevents potential fraud:

Secure Transmission: When providing voided checks to employers or service providers, use secure methods of transmission. Hand-deliver when possible, or use encrypted email systems. Avoid sending voided checks through regular mail or unsecured email.

Verify Recipients: Only provide voided checks to legitimate, verified organizations. Be cautious of requests from unfamiliar companies or individuals, and verify the authenticity of the request through official channels.

Keep Copies: Maintain copies of voided checks you’ve provided, along with records of when and to whom you gave them. This documentation helps track your banking information distribution and can be valuable if questions arise later.

Monitor Account Activity: After providing voided checks, monitor your bank account closely for any unauthorized activity. While voided checks cannot be cashed, the banking information could potentially be misused for other purposes.

Shred Unused Copies: If you make extra copies of voided checks, securely shred any unused copies to prevent them from falling into the wrong hands. The Federal Trade Commission provides comprehensive guidance on protecting personal financial information.

Alternatives to Voided Checks

While voided checks remain the standard for many banking verification purposes, several alternatives exist for situations where providing a physical check isn’t practical or preferred:

Bank Letters: Many banks can provide official letters containing your account and routing information. These letters serve the same purpose as voided checks and may be preferred by some organizations.

Deposit Slips: Pre-printed deposit slips contain the same banking information as checks and can sometimes be accepted as alternatives to voided checks. However, not all organizations accept deposit slips for verification purposes.

Online Banking Screenshots: Some employers and service providers accept screenshots or printouts from online banking systems that show account and routing numbers. Always verify acceptance before using this method.

Bank-Provided Forms: Certain banks offer specific forms designed for direct deposit and automatic payment setup. These forms contain the necessary banking information without requiring a voided check.

Digital Banking Apps: Modern banking applications often include features for sharing account information securely with employers and service providers, eliminating the need for physical voided checks.

Record Keeping and Documentation

Proper documentation and record keeping are essential aspects of financial management, including tracking voided checks. Maintaining accurate records helps you stay organized and provides important information for future reference:

Check Register Entries: Record voided checks in your check register or banking software. Note the check number, date voided, and purpose (such as “direct deposit setup” or “utility automatic payment”). This practice is as important as other professional documentation skills, whether you’re managing finances or developing career skills like learning how to become a firefighter.

Digital Copies: Scan or photograph voided checks before providing them to organizations. Store these digital copies securely, using password-protected files or encrypted storage systems.

Distribution Log: Maintain a log of when and to whom you provide voided checks. Include the organization name, date provided, and purpose. This information becomes valuable if you need to track banking information distribution or if security issues arise.

Follow-Up Documentation: Keep confirmation receipts or acknowledgments from organizations that receive your voided checks. This documentation proves you’ve completed required setup procedures and can help resolve any future disputes.

Just as you might need to carefully manage other types of professional communications, such as learning how to retract an email in outlook, maintaining proper records of your financial documentation requires attention to detail and systematic organization.

Frequently Asked Questions

Can I void a check that has already been written?

No, you should never void a check that has already been filled out with amount, payee, or date information. Always start with a completely blank check when creating a voided check. If you need to cancel a check that’s already been written, contact your bank about stopping payment instead.

Is it safe to email a voided check?

While voided checks contain sensitive banking information, they’re generally safer to transmit than filled-out checks because they cannot be cashed. However, use secure, encrypted email when possible, and only send voided checks to verified, legitimate organizations. Consider using your bank’s secure message system or encrypted file sharing services.

How many times can I use the same voided check?

You can make copies of a single voided check and use them multiple times for different purposes. However, keep track of where you’ve provided this information and maintain secure copies. Some people prefer to void a new check for each use to better track distribution.

What if I don’t have checks but need to provide banking information?

Contact your bank to request alternatives such as an official bank letter with your account information, a counter check, or specific forms designed for direct deposit setup. Many banks provide these services free of charge. You can also ask if the requesting organization accepts deposit slips or other documentation.

Should I write “VOID” in every field of the check?

No, write “VOID” once across the face of the check in large, clear letters. Writing in every field is unnecessary and may obscure important banking information that needs to remain visible. One clear “VOID” across the main body of the check is sufficient and standard practice.

Can a voided check be deposited or cashed?

A properly voided check cannot be deposited or cashed because the word “VOID” makes it clear that the check is not valid for payment. Banks are trained to recognize and reject voided checks. However, the banking information on the check remains usable for electronic transactions and account verification.

What should I do if I accidentally provide a voided check to the wrong organization?

Contact the organization immediately to request return of the voided check. Monitor your bank account closely for any suspicious activity. While voided checks cannot be cashed, the banking information could potentially be misused. Consider changing account numbers if you’re concerned about security, and report any suspicious activity to your bank immediately.